African Economies, defined by their oil exports development?

Described as the continent of the future, Africa, despite all its wealth, remains very vulnerable to global crises. According to many economists, several factors explain the vulnerability of the African continent.

The African economy is mainly based on the export of raw materials and the import of consumer goods and finished products although it tends to change and diversify for a few years now by attracting foreign investments.

The diagnosis

The entrepreneurial spirit of this last decade has allowed several African countries to create numerous SMEs in various sectors of activity that intend to add value to the raw materials exported while exploring the possibilities that the digital economy offers today.

However, these SMEs (Small and Medium Enterprises) and ETIs (Intermediate Size Enterprises), which constitute 90% of the entrepreneurial scene of the continent and account for 60% of total jobs created, are still struggling to access financing, public markets, and international value chains. They were of course heavily affected with considerable loss of business income by the restrictions linked to the Covid-19 health crisis and the closing of borders, lockdowns, and local curfews.

Some countries have applied some policies to help SMEs and SMIs such as tax and social security rebates, and others have chosen to allow companies operating in their territory to defer the payment of these social security contributions. Now that many restrictive measures are gradually being lifted, world trade is picking up, commodity prices are rising and financing conditions are improving but the crisis between Russia and Ukraine is jeopardizing the recovery of the African economy since many African economies are heavily dependent on Russian and Ukrainian agricultural production.

Russian and Ukrainian wheat, for example, accounts for 30% of the world’s wheat production, 50% of which is exported to Africa. In some countries, the populations are already beginning to feel the consequences of this crisis, in some African countries the price of bread has increased.

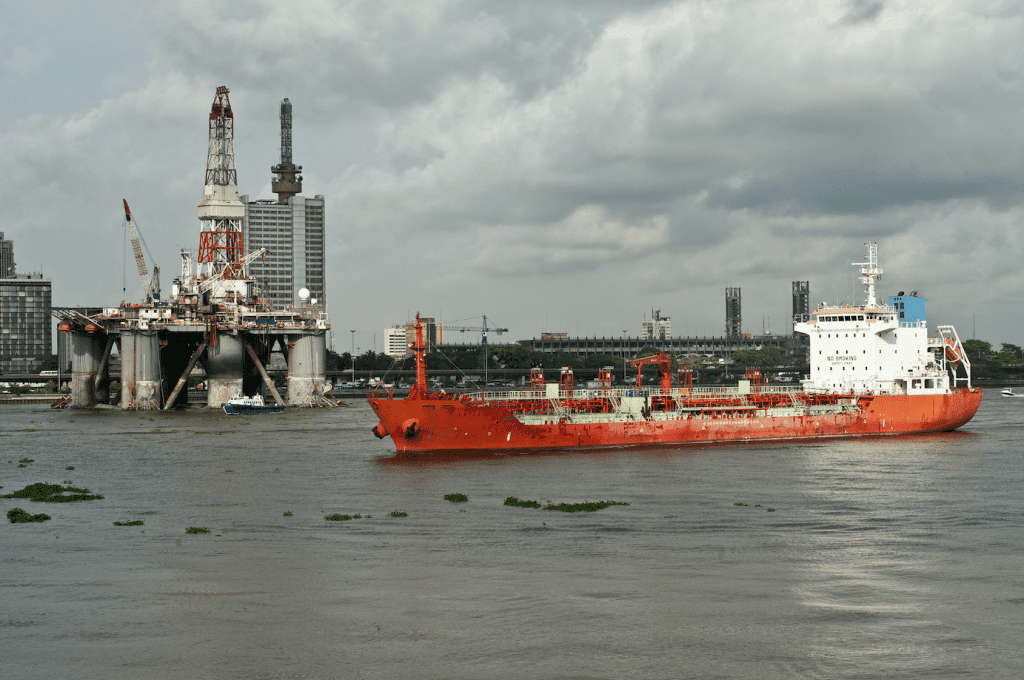

The role of oil and its effect on the current circumstances of the supply chain in Africa

The freight rates increase

Africa being overall an import market, its economy has been, like in many countries in the world, negatively impacted by these two last years of the Covid-19 health crisis. The cost of importing goods has been significantly increased and the freight rates have reached unseen levels so far, especially from Asia, and these freight increases have been passed to final consumers. With the current conflict in Ukraine, freight rates continue to increase because of the Bunker Adjustment Factor BAF added to freight rates, these surcharges are indeed based on fuel prices.

African oil, on the plus side

However, an increase in oil prices is not only bad news for Africa. The continent has never been so vital in quenching the world’s thirst for oil! Heavy sanctions against Russian oil and gas could have important consequences for the European economy and citizens. All eyes are now on other producing countries. In the Middle East, Saudi Arabia, Iran, Iraq, and Qatar have reserves but will not be able to compensate for the missing volumes of Russia. In Africa, the four main producing countries (Nigeria, Libya, Algeria, and Angola) account for about 80% of African hydrocarbon production.

The economy of many African countries is very much dependent on oil production as this is the case not only for Nigeria, Angola, Algeria, Libya but also for Congo Brazzaville, Gabon, DR Congo, Egypt, Equatorial Guinea to name a few. A very important part of these countries’ oil is extracted offshore with higher operational costs compared to onshore extraction. To make it economically viable, the barrel price needs to be over USD 70. A high oil price is, therefore, more than welcomed by many countries in Africa as this means higher revenues. It has been eight years since the price of crude oil per barrel was over 100USD. This price escalation was triggered by the conflict in Ukraine, which led to a cascade of Western sanctions against Russia and led to fears of a significant drop in sales by the world’s second-largest exporter, which is increasingly cut off from international markets.

If the European Union decides to boycott its Eastern neighbor and if the Organization of Petroleum Exporting Countries (Opec) persists in maintaining its production at the current level, some traders fear that prices per barrel may even rise up to 200USD. Even during the financial crisis in 2008 prices did not reach this level.

Un urge for positive investment

By selling their products on international markets, African oil companies will make important profits, but the question remains whether these profits will be used in a clever way, i.e., relocating refining and investing more in local infrastructure to stimulate local consumption and the diversification of the economy. Many consultants are optimistic and believe that the growth of this sector will benefit local economies and will help reduce poverty and support economic growth.

On the other hand, it is important to mention that most of the crude oil-exporting African countries lack refineries which means that they still depend heavily on imported refined fuels. The rising oil prices will therefore also affect the cost of their imported fuels.

The consequences for Africa are numerous and sometimes contradictory. African economies are still heavily dependent on oil, both for the transport of people and goods and for energy, with many homes and businesses equipped with diesel generators. Any increase in the price of oil, therefore, affects purchasing power, freedom of movement, and access to electricity. But oil is also one of the continent’s main rents: sales of this resource account for almost half of the GDP of Libya and Congo-Brazzaville, a quarter of Angola’s, and a fifth of Gabon’s, according to the World Bank. Sub-Saharan Africa is benefiting from the high oil price, as the region produces more oil than it consumes but there are significant disparities between producing countries; some of them benefit from it, but there are as well importing countries, for whom the situation is much more complicated.

According to the IMF (International Monetary Fund), economies importing crude and refined oil products will see their budget and trade deficits rise, jeopardizing the recovery from the Covid-19 health crisis.

The conclusion

As a whole, the rise in the price of oil is accompanied by an almost a general increase in the price of natural resources as well. This should help oil-importing countries that produce gold, copper, aluminum, and other commodities to balance their trade balances in search of a better-off position.

In its market analysis, the African Energy Chamber estimates that African oil production is expected to grow by 315’000 BPD (barrels per day) in 2022 to 6.35 Mbps (million barrels per day). See the map above with the ranking of oil-producing countries in Africa by volume.

African countries must seize the opportunity offered by the Africa Continental Free Trade Area (AfCFTA) to make the continent’s economy less dependent on foreign crises, incentive regional trade, and improve the regional economic exchanges.

Get the full picture by reading also:

- Financial Afrik: https://www.financialafrik.com/2020/05/08/limpact-du-covid-19-sur-les-pme-en-zone-uemoa-bloomfield/

- France 24: Economic Intelligence program, October 21, 2020, https://youtu.be/EOEl8JXOPB

- Agence Ecofin: https://www.agenceecofin.com/entreprises/1511-82456-cette-crise-a-revele-quelque-chose-de-fondamental-les-africains-doivent-prendre-leur-destin-en-main-stanislas-zeze

- French Development Agency: https://www.afd.fr/fr/actualites/soutien-pme-africaines-covid-19-developpement-durable

- Ports et corridors https://portsetcorridors.com/2022/petrole-afrique-en-2022/

- Organismes.org – Classement des pays producteurs de pétrole en Afrique: https://organismes.org/classement-des-pays-producteurs-de-petrole-en-afrique/

- Jeune Afrique https://www.jeuneafrique.com/1333885/economie/crise-du-petrole-en-afrique-qui-gagne-qui-perd/