There are many projects on the way in Africa’s maritime sector as governments pursue ambitious port expansion projects. The port sector of many countries in the continent has attracted 15 billion US$ in private investment and a total of 85 billion US$ including public funding. Most of this growth is funded by increasing levels of debt so the profitability of these projects will be the key to their feasibility.

In Africa Tangier Med and Port Said have taken the lead in North Africa, Djibouti in East Africa and Durban in Southern Africa. In West Africa, some countries are in competition to become the leaders in the sub-region with ambitious ports development projects.

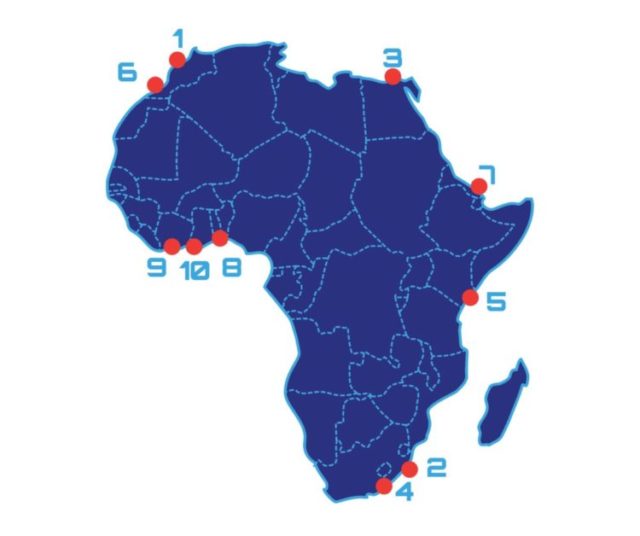

The Top-10 ports in Africa by volume in TEUs

- Tangier (Morocco)

- Durban (South Africa

- Port Saïd (Egypt)

- Coega Nqura Port Elizabeth (South Africa)

- Mombasa (Kenya)

- Casablanca (Morocco)

- Djibouti (Djibouti)

- Lomé (Togo)

- Abidjan (Côte d’Ivoire)

- Tema (Ghana)

The main candidates to become the Number 1 regional hub in West Africa

Lomé (Togo) – 1

TIL Terminal Investment Limited (owned by MSC) has started to invest US$380 million in Lomé/Togo. This port is now able to handle post-Panamax vessels and acts as a trans-shipment hub serving the smaller ports of the region that cannot handle large vessels; all MSC’s Asia-West Africa volumes are nowadays trans-shipped in Lomé.

In just a few years, Lomé port has increased its cargo volumes from 300’000 TEUs in 2013 to 1.5 million in 2019, becoming West Africa’s busiest port. However the fierce competition of other ports in the region like Lekki in Nigeria, Abidjan and Tema in the near future.

Tema (Ghana) – 2

Located in the industrial city of Tema, 30 km from the capital city of Ghana, Accra. A joint venture between the French company Bolloré and APM Terminals (Maersk) in 2015 to secure US$1.5 billion funding for Ghana’s Tema Port will run the project which will considerably increase the capacity of the port. There will be a 1.4 km quay with 4 deep berths, modern gantry cranes and terminal operating systems.

The capacity to accommodate vessels will be four times greater than today and the port will be able to operate container ships carrying up to 18’000 containers. This investment is needed to allow the port to accompany the country’s dynamic economy and vessels which are bigger and bigger and will also have a positive effect on operational costs making shipping in Ghana more cost-effective and competitive.

Lekki (Nigeria) – 3

A US$1.5 billion port project in Lekki port is expected to open for operations in 2023, which will receive the volumes that should shift from today’s heavily congested Apapa/Tincan port area and pretend to be a trans-shipment hub for West Africa.

It is designed to be able to operate vessels with a capacity exceeding 18’000 TEUs. Lekki is located at the heart of the Lagos Free Trade Zone. Apapa and Tincan ports are today very congested and a lot of Nigeria’s import volumes are discharged in neighbouring countries ports like Cotonou and Lomé.

Abidjan (Côte d’Ivoire) – 4

The completion of Abidjan port’s expansion project by China Harbour Engineering has improved cargo handling capacity. The project represents an investment of US$930 million with 3 container berths, 1 Ro-Ro berth and general cargo berth; this infrastructure improvement will help the country to expand its economy.

Ndayane Le Port du Futur Dakar (Sénégal) – 5

With the construction of a new port in Senegal by DP World, le Port du Futur, Senegal will have a port with a capacity of 1 million TEUs. This project includes the development of the Dakar Integrated Special Economic Zone (DISEZ).

The port is located at 50 km from Dakar and once the project is completed the current port of Dakar will progressively close and its volumes will be switched to Ndayane Port du Futur. Dakar is today a trans-shipment hub for Grimaldi Lines.